Transform Your Business, Transform Your Life

Learn How The Most Profitable Business Owners In The World Use 'Counterintuitive Thinking' To Earn More Money, While Working Less!

Watch My Detailed Video Showing You A Simple Strategy That...

Strategies that can DOUBLE The Bottom-Line Profit

Of ANY Business... Using The Power Of Exponential Growth!

(Hint: Your competitors are NOT aware of this)

And You Can Implement It In A Single Afternoon!

Inspire, Empower, Succeed.

One-On-One Coaching

Looking for professional help that’s affordable? I will help you increase your leads and sales, generate leads, create marketing that actually produces results, increase your revenue substantially, and position your business as the dominant force in your industry.

Group Coaching

My group coaching program will allow you to not only learn new business growth strategies from me, but also other small business owners with the same goals as you have for your own business. We will work on application of these strategies because knowledge is pointless without using it.

Profit Acceleration Simulator

Success is achieved through small, incremental changes in multiple areas of your business. We've defined 12 areas that generate immediate increases both revenue and profits, without spending a cent on marketing or advertising.

DIY Online Learning

Everything a Small Business Owner needs to know to improve profits. Includes access to all business spreadsheets, e-classes, internet marketing videos, sales letters, profitable headlines, proven marketing material strategies, articles, tips and much more!

Unleash Your

Business Brilliance.

Turn Your Vision into Reality with Expert Guidance.

Building Bridges to Your Business Dreams.

Inspire, Empower, Succeed.

Watch this complete training video on the power of Profit Acceleration.

Unleash Your Business Brilliance.

We will assess your business using our revolutionary new Profit Acceleration Software™. We will then detail the specific strategies that can generate massive financial breakthroughs for your business.

At the end of our session I will send you your own customized roadmap for success along with a detailed report that will position your business as the dominant force in your industry.

Guiding You to Profitable Possibilities.

Navigate the Path to Business Greatness Through Community.

Empowering Business Owners to Thrive

Invest in Your Business, Invest in Your Success.

Driving Growth, Amplifying Impact

Get In Touch

Email: [email protected]

Address

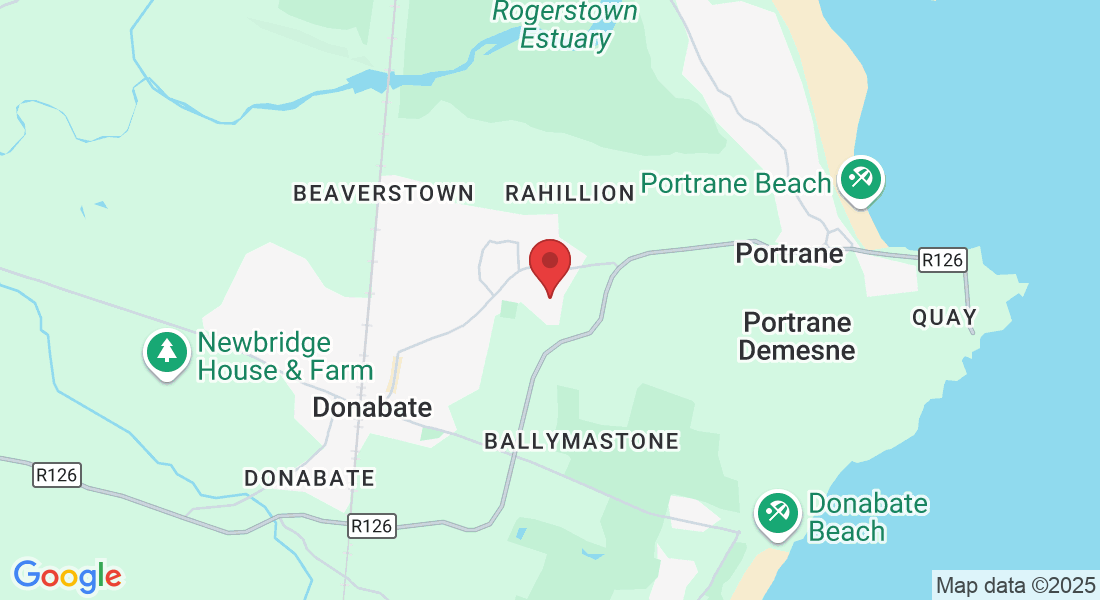

Office: Dublin, Ireland

Assistance Hours

Phone Number:

083 431 6314

Unleash Your Business Brilliance.

I help serious business owners and organizations generate more clients, close more sales, and increase their overall revenue and profits quickly and inexpensively

***DISCLAIMER:

The information contained on this Website and the resources available for download through this website is not intended as, and shall not be understood or construed as, professional advice. While the employees and/or owners of the Company are professionals and the information provided on this Website relates to issues within the Company’s area of professionalism, the information contained on this Website is not a substitute for advice from a professional who is aware of the facts and circumstances of your individual situation. Nothing on this site, nor advice from our experts, shall constitute legal advice.